-

Company

-

Who We Help

-

Customer Loyalty Programs

Services to enhance customer loyalty and engagement.

Loyalty Management Programs

Tools for loyalty program managers.

Financial Service Providers

Solutions tailored for banks, credit cards, & other financial institutions.

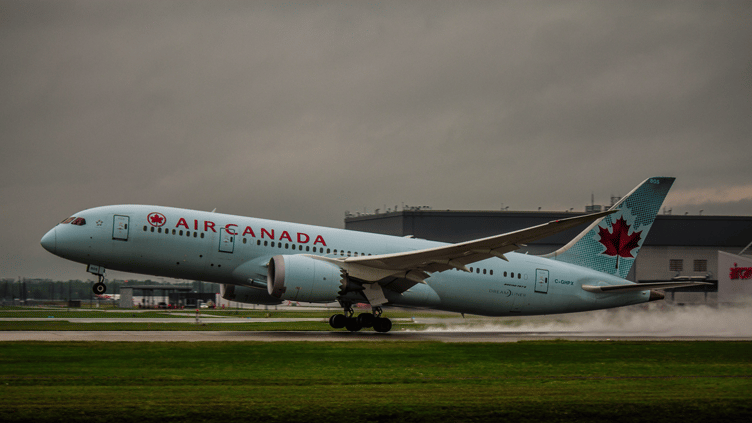

Airlines

Services and solutions for airline loyalty programs.

EMPLOYEE REWARDS

Rewards & Recognition Solutions

Travel offerings for employee recognition platforms.

Employee Rewards Programs

Tailored rewards solutions for employees.

MEMBERSHIP ORGANIZATIONS

Membership Organizations

Benefits for your organization and it's members.

FEATURED

-

-

Solutions

-

SOLUTIONS

Customer Experience

Enhancing customer experience through travel.

Employee Experience

Improving employee satisfaction with travel benefits.

Case Study

-

-

Features

-

FEATURES

Dynamic Packaging

Bundling travel services for unique offerings.

White-Label Travel Platform

Customizable travel platforms for brands.

Machine Learning & Artificial Intelligence

Advanced analytics for travel services.

Webinar

-

-

Resources

-

RESOURCES

2025 Trend Report

Latest trends in the travel industry.

Travel Buddy Podcast

Podcast discussing travel topics.

Resources

Educational and informational resources.

Travel Industry Insights

Insights and analytics for the travel industry.

Blog

Articles and updates from Switchfly.

FOR DEVELOPERS

API Documentation

Technical documentation for developers.

Case Study

-

-

Contact Us